Crypto Stocks. Zakat is due on the market value on ones Zakat anniversary.

How To Calculate Zakat On Cryptocurrency Zakat Foundation Of America

Your total assets minus your immediate debts and expenses equals your Zakatable wealth.

Crypto zakat calculator. However finance has changed quite a lot since the time of the Prophet Muhammed PBUH. If a cryptocurrency is not purchased to resell a coin currency such as Bitcoin Litecoin Ripple. The hawl is the the Zakat Year like a fiscal year but used to calculate your Zakat.

The short answer on Zakat due on stocks shares and bonds. The cryptocurrency value should be converted into ones local currency at the time of calculation. The term crypto is broad and includes a whole range of crypto-assets.

Gold silver cash savings investments rent income business merchandise or profits shares securities and bonds all qualify as part of the calculation. If you own say one Bitcoin and your Zakat Due Date were today your Zakat payment calculation on it would be this. The amount of Zakat is calculated at 25 of liquid assets held for at least a full year.

The product amount is your Zakat payment on that crypto denomination. Crypto Stocks. Since cryptocurrency like Bitcoin qualifies as a liquid asset Muslims must take care to include.

Basics Calculate Spiritual Community Give Zakat on LaunchGood. Just follow the form below to calculate your Zakat. To work out your Zakat we need to add up all the things you own take away anything you owe to others which gives us a total figure of your wealth.

The Zakat due would be 25 of that wealth. At the end you dont have a lingering feeling youve missed something. Do I pay Zakat on Cryptocurrency.

A -D W If your Zakatable wealth is equal to or above the nisab. 3856060 Bitcoin value per 1 x 0025 gm 96402 Zakat Payment Note that all forms of currency have Zakat. Modern Muslim Zakat scholars regard shares and stocks as partial ownership of the capital of a corporation or business entity.

They assess bonds even when these represent in part the forbidden financial practice of interest as likely. Whereas Zakat-al-maal varies based mostly on an individuals wealth the quantity for Zakat-al-fitr is particular with each Muslim required to present the minimal quantity. Thats why todays young Muslims must prepare for Zakat in the.

You can also convert your gold silver and cryptocurrency to their cash value. Although the real-world value of the coins can be volatile an increasing number of Muslims have acquired Bitcoins and other crypto currencies prompting a discussion on how to calculate Zakat. Today many Muslims are making money on stocks shares bonds cryptocurrencies and NFTs.

If a cryptocurrency is not purchased to resell a coin currency such as Bitcoin Litecoin Ripple etc will still be Zakatable because of their utility as currencies within their. Do I pay Zakat on stocksshares. Your favorite Zakat all in one place.

Crypto Stocks. Any cryptocurrency or token purchased to resell will always be Zakatable. Do I pay Zakat on stocksshares.

There are two varieties of Zakat in Islam Zakat-al-maal which is the Zakat on an individuals wealth and Zakat-al-fitr which is particularly linked to Ramadan. Zakat is due on the market value of your Crypto. Zakat is a big old subject with so many fiddly questions.

Do I pay Zakat on Cryptocurrency. Zakat is an essential part of Islam and is considered the third of the five Islamic pillars. Find the value of 85 grams of gold in your crypto currency.

Steps for calculating your Zakat on Crypto. The cryptocurrency value should be converted into ones local currency at the time of calculation. Your favorite Zakat all in one place Give Zakat on LaunchGood.

What do I need to pay Zakat on. Regardless of whether your cryptocurrency holdings are tokens utility or work or exchangeable coins both are liable for Zakat. Zakat is due on the market value on ones Zakat anniversary.

For a start you automatically get a free portfolio health check as well. The hawl starts when your assets first reached the minimum niṣāb or when you last paid Zakat. Bitcoin is a crypto currency or decentralized digital currency that has gained traction in recent years.

In this FAQ which we will add to as we go alone we aim to cut through the noise and help you get the answer you need quickly. We also have a carefully-crafted zakat calculator designed to quickly calculate your zakat but in an accurate way. Once 1 lunar year has passed and your assets have been consistently above the niṣāb you pay Zakat on your assets at that point.

This is a zakat calculator like none you have seen before. Is zakat due on cryptocurrency. Find that out and more on how you can work that out through our webinar as Zakat on crypto can be as mystifying as the crypto world itself.

Next we cater for a vast universe of assets. Yes and there is a Zakat Calculator for this. To determine how much Zakat is due well use a simple formula.

It is useful to understand that any crypto-asset whether it be a currency or a platform token if purchased with the intent of capital gain and to resell in the short-term then these will be 100 Zakatable no matter the nature of the asset. Zakat Simplified is an initiative by Ethis and GlobalSadaqah to discuss various aspects of Zakat and how to calculate it for a nisab.

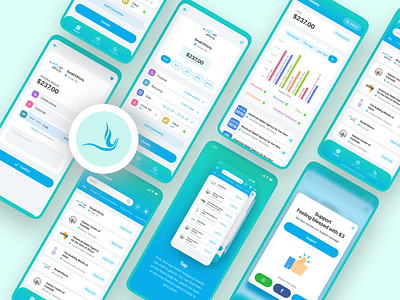

Zakat Calculator Web Ui Design By Ademir Alimanovic On Dribbble

Zakat Designs Themes Templates And Downloadable Graphic Elements On Dribbble

Zakat Calculator Incoming Call Incoming Call Screenshot Ios Messenger

Zakat Penghasilan Zakat Fitrah Dan Zakat Mal Apa Bedanya Dan Berapa Jumlahnya Pendidikan Agama Perencanaan

Zakaat Charity In Ramadan Maulana Tariq Jameel Wisdom In Islam Pendidikan Agama Perencanaan

Zakat Calculator Pro Free Download And Software Reviews Cnet Download

0 Comments