In March 2014 the IRS published a notice clarifying that all crypto-currencies should be treated as property for tax purposes. Bitcoin Ether or used it to pay for goods or services you have engaged in a reportable transaction and may have a tax liability.

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker

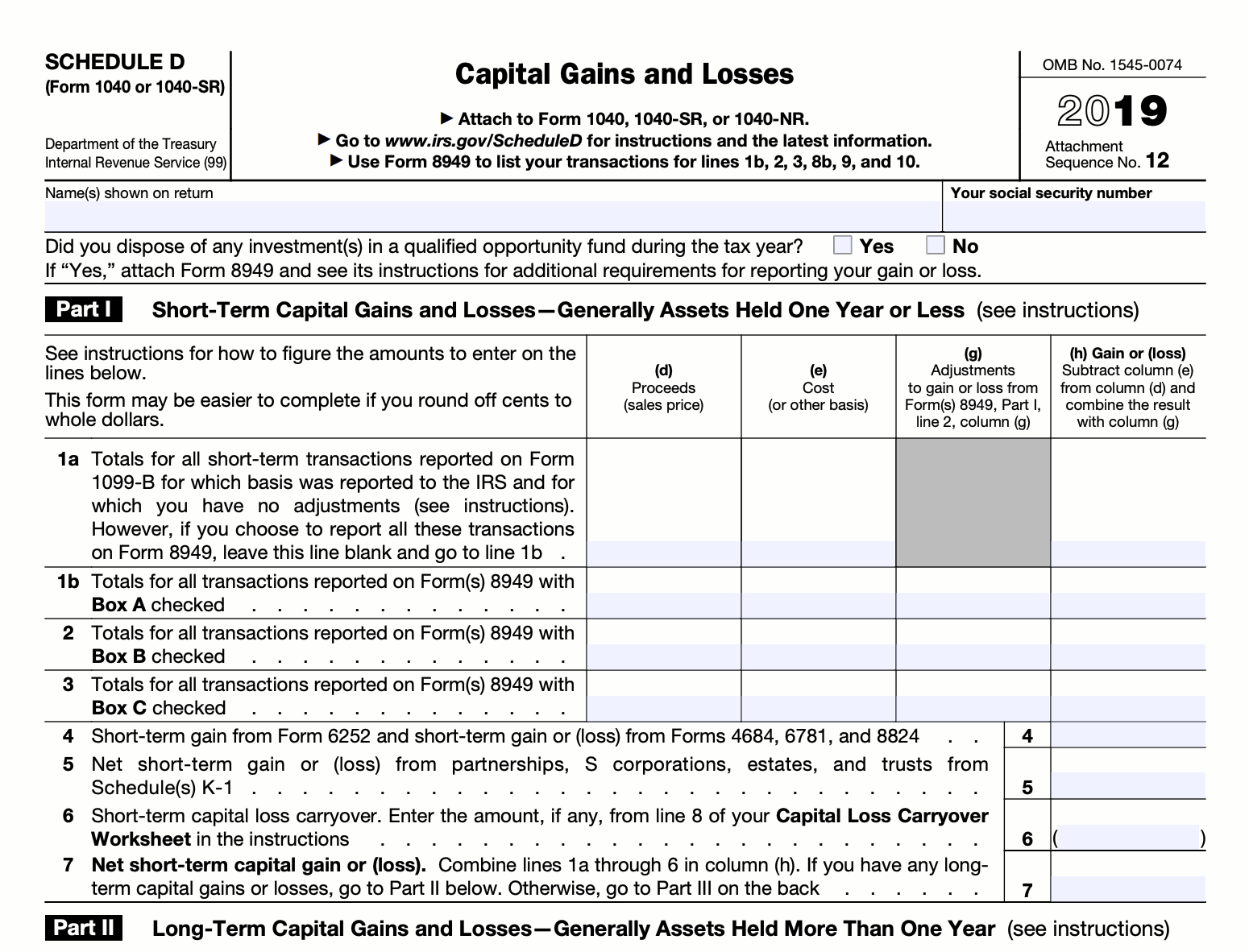

Schedule D Form 1040 is used to report your capital gains and losses in the sale or exchange of capital assets that are not held for business or profit.

Schedule d cryptocurrency. Be sure to check out our series from last year to get prepared to deal with crypto taxes before April 15th. As you complete your Form 1040 you have to move information from Form 8949 over. Stock or crypto the IRS and most states want a piece.

This ensures your income and tax liability calculations are accurate. However unlike stocks and shares we dont have a broker that. This includes cars artwork collectibles stocks and bonds and yesyour cryptocurrency.

Include both of these documents with your holistic tax return. Schedule D for cryptocurrency gains. For a detailed walkthrough of the reporting process please review our article on reporting cryptocurrency on your taxes.

Click the row if they are not visible. Once you have each trade listed total them up at the bottom and transfer this amount to your 1040 Schedule D. The Schedule D is the form that you use to report capital gains and losses from all personal property.

Form 1040 Schedule D Capital Gains and Losses Commonly referred to as just Schedule D this is the summary of your capital gains and losses. To calculate and report capital gains and losses on the sale of cryptocurrencies taxpayers will need to file IRS Form 8949 and the subtotals carry over to Schedule D Form 1040. Schedule D summarizes what you reported on Form 8949.

Written by tac in Investing Tax. You will also need to include the totals from 8949 in your Schedule D. If you sold exchanged or disposed of virtual currency eg.

Schedule D Capital Gains and Losses with an aggregate sum of your capital gains across all asset classes. These transactions may be reportable on Schedule D. Gains and losses on capital transactions are calculated on Form 8949 and reported on Schedule D.

Each sale of mined cryptocurrency has to be reported on the tax form for. Please note ordinary income is not reported on a Schedule D form. Thats the First In First Out accounting method or FIFO.

Schedule 1 new in 2019. TaxBit provides the required IRS 8949 cryptocurrency tax form which will be transposed onto a taxpayers Schedule D tax form. The IRS and most exchanges automatically assume that you are choosing the sell the first coins purchased each time rolling that forward into the next coins as needed to total up to the amount of sale.

This is the form that you will ultimately report your capital gains from your crypto trading activity. Once you have your net capital gain or loss from all of your cryptocurrency disposals reported on 8949 you simply transfer this number to Schedule D of your tax return. Form 1099-MISC Miscellaneous Income This Form is used to report rewards fees income from staking Earn and other such programs if a customer has earned 600 or more in a tax year.

At least not in the United States. Schedule D Capital Gains and Losses. Write these values add if you have other Form 8949s into the appropriate boxes on your Schedule D form.

Form 1040 Individual Income Tax Return including your Schedule D information. However before filling out the schedule D you. This schedule is also generated by crypto tax software.

Not much has changed in the crypto world when it comes to taxes. Include both of these forms with your yearly tax return. Capital gains like stocks and shares are reported on your 1040 tax form as part of Schedule D.

Include your totals from your Form 8949 on your Form Schedule D as indicated on the form. Net totals from all trades carried to Schedule D. Note that you can carry cryptocurrency losses over from.

If you are engaging in crypto activities as self-employed use the Schedule C instead. The values are shown underneath the download link. Complete the rest of.

Therefore any gains from exchanging such property would be considered capital income and taxed as capital gains. Include your totals from 8949 on Form Schedule D take your total net gain or net loss from 8949 and add it in Schedule D Include any crypto income on Schedule 1 or Schedule C if you are engaging in crypto taxes as self-employed Complete the rest of your tax return What are the tax rules for cryptocurrency. If you have crypto income include the crypto income totals on the 1040 Schedule 1.

Use Schedule D to complete this task. First question about cryptocurrency plus any income from forks airdrops mining or payments will go on the other income line 21.

How To Report Cryptocurrency On Taxes Tokentax

How To Report Cryptocurrency On Taxes Tokentax

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker

Understanding Irs 8949 Cryptocurrency Tax Form Taxbit Blog

Declare Your Bitcoin Cryptocurrency Taxes Irs Koinly

Scarce Bitcoin Halving Roadmap Bitcoin Cryptocurrency News Cryptocurrency

0 Comments