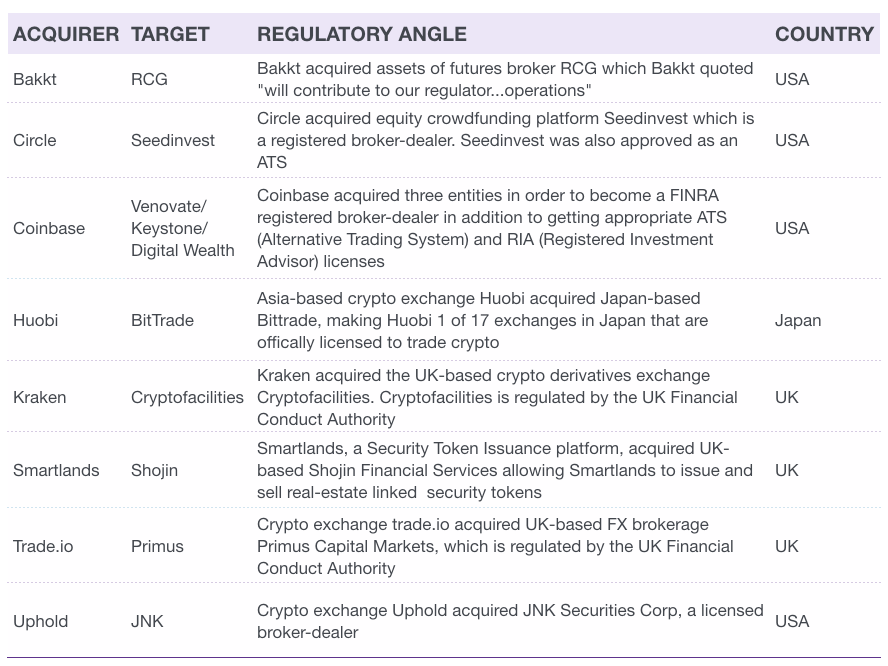

MA as a way to overcome regulatory hurdles. Crypto native platforms are expected.

Crypto M A Barbarians On The Blockchain Tokendata Research

Since going live in 2015 the exchange has offered investors secure and compliant crypto investing opportunities with advanced features yet at slightly higher trading fees.

Crypto exchange m&a. Thus the section covers both individual crypto exchange updates and aggregated exchanges news. The exchanges I make through Krypto Exchange get through really fast. The maturation process of exchanges has made them the apex predators of the space engaging in MA and positioning themselves for entry into the public markets.

This acquisition enabled Kraken to accelerate its entry into the UK. Crypto-to-Crypto and Crypto-to-Fiat Exchange operations as well as Crypto Custody services are covered by EU licenses. Marketplace and to obtain regulatory licenses.

MA is used by cryptocurrency exchanges as a strategic tool to gain regulatory approval in certain jurisdictions or for certain products. Recent trends include professionalizing through hiring and regulatory positioning as. Bankman-Fried said FTX has.

Each crypto exchange is unique and differs based on the number of listed entries and trading volume. Financial Conduct Authority FCA. Moreover while we have not seen an actual case of Decentralized MA yet there have been deals involving protocols and ICO-funded teams.

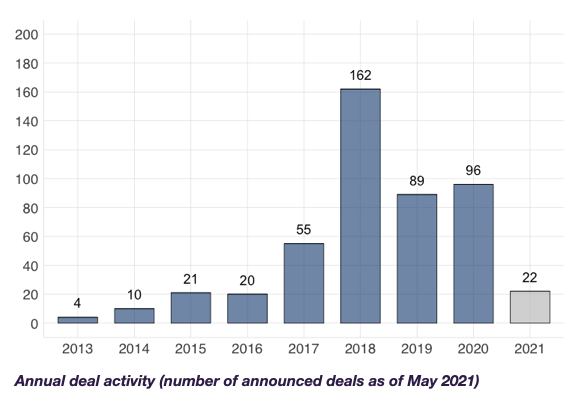

The report further found that the first half of 2020 saw an increase of MA transactions involving crypto exchanges and trading infrastructure driven mostly 74 by existing players strategic acquisitions. Some of the most notable deals in the crypto space in 2020 include major crypto exchange Binances acquisition of CoinMarketCap which was valued at 400 million and Coinbases 4179. MA in cryptocurrency markets is thriving as discounted valuations due to plunging crypto markets make blockchain and crypto startups attractive to investors.

The liquidity on Krypto is simply amazing James Harris. Now that you have coins to trade you can exchange them for coins such as Monero and Ethos. It has launched programs through which users can earn up to 74 APY on their assets and also offers benefits that include a Gemini credit card.

They do so by acquiring a company which has the relevant regulatory licenses. You can expect to see more activity in the MA space in the coming months as more institutions wallets exchanges and DeFi services embrace. Crypto exchanges have gone from nothing to a relatively mature industry very quickly.

Given the complex regulatory landscape in the industry MA can often be the most rapid method of gaining access to new international markets. Global Crypto MA and Fundraising Report 5 Key takeaways when comparing 2018 vs 2019 There was a sharp decline in deal volume and value for crypto fundraising and MA in 2019 and investments have been shifted towards Asia EMEA and into more diversified sectors The crypto winter continued in 2019 for crypto fundraising and MA with both the. Yehor Kruhian Im a newbie to crypto trading and Krypto guided me through my transition from a stock trader to a crypto trader.

There are plenty of reasons not to use cryptocurrency as payment in an MA transaction including lack of price certainty and limited but growing usability as a means of exchange. As a matter of fact even amid market lows during the first half of 2020 cryptocurrency-related MA hit 600 million more than the total for all of 2019. Unstoppable API Get access to all trading features and data stream and be sure in your trading strategy execution.

Bullish the decentralised exchange backed by a group of billionaire investors announced plans to list in New York through a Spac deal with a valuation of around 9bn. These used MA to expand their. For example in February Kraken acquired Crypto Facilities an exchange registered with the UK.

A cryptocurrency exchange matches buyers to sellers enabling users to sell purchase trade and often store their coins and tokens. Crypto-only operators will attempt to offer broader financial products a factor that could influence their MA decision-making. Crypto Exchanges Decentralized MA Exchanges and other trading-related companies were the most active strategic buyers in the first half of 2020.

Cryptos increasing presence in mainstream markets has continued to attract significant investor interest with the value of mergers and acquisitions MA in the. From your crypto wallet you will need to send Bitcoin or Ethereum or whatever medium of exchange the crypto exchange uses to the corresponding cryptocurrency address on your trading account. Since 2013 the blockchain industry has seen 129 MA transactions with an aggregate deal value around 29 billion per The Blocks research findingsThe post Crypto exchanges lead the way for.

Cryptocurrency MA Will Continue to Gain Momentum.

Coinbase Binance And Kraken Lead In Blockchain Merger Acquisition Deals Nairametrics

Tokendata Research Crypto Data Research

Tokendata Research Crypto Data Research

Can We Fund M A With Bitcoins Ipleaders

Crypto M A Activity Accelerates At Warp Speed In 2021 Bitcoinist Com

Leading Crypto M A Transactions By Value 2020 Statista

0 Comments