Some Exchanges have Been Reporting Customers Cryptocurrency Income Using Form 1099-K. If youve earned 600 or more this year in crypto interest or bonuses the 1099-MISC will be made available by the platform that issued the payments by January 31 2021.

The IRS has yet to provide firm guidance on the specific form to use in reporting gains for crypto gains and losses but the change in 1031 like-kind exchanges legislation earlier this year moved many of these transactions closer to the 1099-B space.

Crypto exchange 1099. When doing so the IRS is also notified of the information contained on the tax form. To properly report your taxes on your trading activity. Here is how it works.

Robinhood issues the 1099-B instead of the 1099-K to show. Coinbase or your other cryptocurrency exchange sent you a 1099-K because they had to and because you had over 20000 worth of transactions or over 200 transactions. It is important to note that many cryptocurrency exchanges are now moving away from Form 1099-K.

The US crypto exchange called Robinhood issues a 1099-B Proceeds from Broker and Barter Exchange Transactions since it is a closed trading platform. The 1099 does not show the amount you owe in taxes and using it to report taxes would be inaccurate. When people begin receiving 1099-K forms from their crypto-exchange accounts for crypto trades that did not involve selling cryptos for dollars all hell is going to break lose.

For most states the threshold is set by the IRS at 20000 USD and 200 transactions in a calendar year. This is thanks to the matching mechanism embedded in the IRS Information Reporting Program IRP. You also have to complete transactions in cryptocurrency trading on the platform in the previous year equal to or exceeding 600 worth.

For those trading in cryptocurrencies crypto trading platforms are required to provide you with a form 1099 for use on your taxes. Cryptocurrency exchanges are beginning to remedy the problem that Form 1099-K created by filing Form 1099-B which is the tax form intended for capital asset transactions such as cryptocurrency and other commodities. And although you will receive either a form 1099-K or a 1099-B it is not always clear what the information is saying.

When doing so the IRS is also notified of the information contained on the tax form. It is possible that other exchanges may have been following this practice as well. The total value of crypto that you have bought sold or traded on an exchange.

Crypto Exchanges How to Read Your Brokerage 1099 Tax Form. 1099-Ks 1099-Bs Report Crypto Transactions If you receive a Form 1099-K or Form 1099-B from a crypto exchange without any doubt the IRS knows that you have reportable cryptocurrency transactions. They will probably and mistakenly report the information on their tax returns because they dont know any better or ask a CPA or attorney for advice who will mistakenly tell them to report the amounts on their tax.

This form leads to reporting of income when no income was actually generated on the exchange. The Form 1099-K states your cumulative amount traded in a tax year. What to Do With Your Crypto 1099.

A couple of cryptocurrency exchanges have issued 1099-Ks which is an informational return that sums up the total value a user has received throughout the year. If youre an active cryptocurrency. Foreign exchanges do not issue a 1099-K.

The IRS was sent a copy of this 1099 so they are aware of your activity. For those trading in cryptocurrencies crypto trading platforms are required to provide you with a form 1099 for use on your taxes. Exchanges give a 1099-K.

The form notes all your capital gains and losses dividend and interest payments and any other investing income made in your brokerage account. Coinbase stopped issuing a 1099-K in 2020 because the IRS failed to issue guidance for reporting requirements for crypto exchanges. Some of the most prominent cryptocurrency exchanges issue a specific type of 1099 known as form 1099-K to qualifying customers.

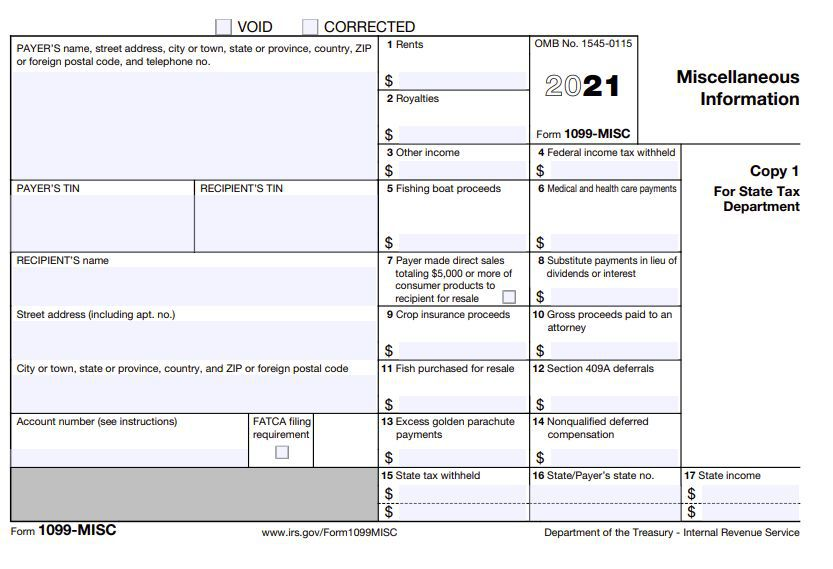

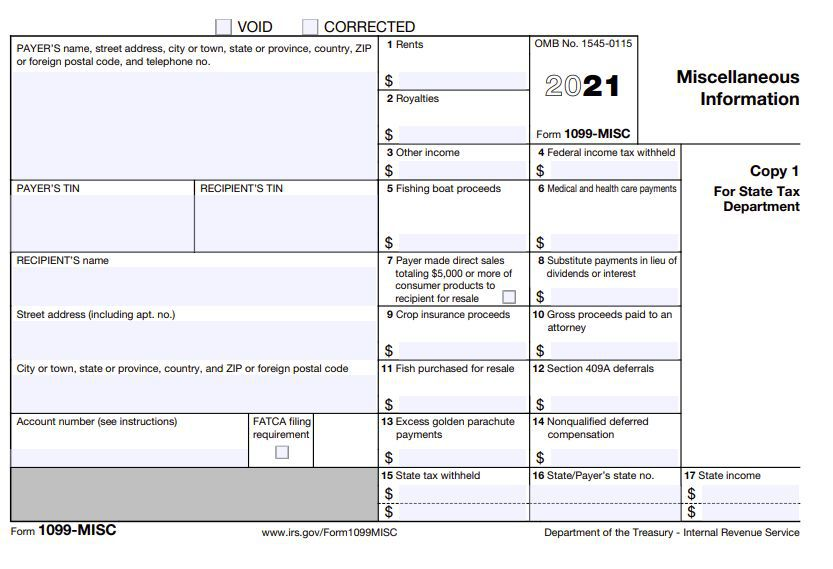

To help you do this your brokerage firm will send you a 1099 tax form. Asked 1 month ago by A friend of mine is looking to trade crptocurrencies and I subsequently warned him that hell have to keep careful track of all of his transactions throughout the year because he would have a. Crypto exchanges issued 1099-MISC forms to reported reward and staking income.

US Crypto Exchanges 1099-B. This includes currency awarded through Coinbase Earn Staking or USDC Rewards. This form provides information for a wide range of income payments such as crypto interest referral bonuses and other income.

In order to receive Form 1099 you have to be an account-holder on Coinbase in the US or US tax-compliant areas. Learn how to read your 1099 tax form so you can be better prepared. How can crypto exchanges avoid sending a 1099-B.

This form is also known as a Payment Card and Third Party Network Transactions form.

Good Morning Bitcoin Milionaires The Cryptocurrency Crash Has Given All The Opportunity To Buy Altcoins At Discount Prices Buy Cryptocurrency Bitcoin Ripple

What Is A Cryptocurrency 1099 Coinbase 1099 Misc Tokentax

The Sec Crackdown On Suspicious Cryptocurrencies Is Getting Serious Blockchain Crypto News Regulation Financial Indus Cryptocurrency News Bitcoin Pump And Dump

Bitcoin 1099 Misc Bitcoin This Or That Questions Bitcoin Wallet

Mexo Review A New Cryptocurrency Exchange For Mexico Latam Wallstreet Cryptocurrency Cryptocurrency Trading Insurance Fund

What To Do With Your Crypto 1099 Https Thecryptoreport Com What To Do With Your Crypto 1099 Crypto1099 Stock Quotes Investment Advice Social Media Terms

0 Comments