As the market cap number increases the value of the crypto currency raises which means it is gaining more popularity. Continue reading Why Cryptocurrency Market Cap Doesnt.

The Value Of Crypto Market Capitalization Do Coin Prices Matter

Price is the current value of a.

How does market cap affect cryptocurrency. Long after I first invested in crypto the concept of market cap still seemed mysterious and technical. There are few alt coins which are priced more than Bitcoin but they are not popular. Market capitalisation is an indicator that measures and keeps track of the market value of a cryptocurrency.

Market Capitalization Market Cap of any coin can be calculated by multiplying the total circulating supply of a cryptocurrency with its latest price. It proves that this crypto is developing and digital money is becoming an increasingly popular means of payment. Market cap is the total value of a crypto and this is one of the most important unit to consider when evaluating Cryptocurrencies.

For this reason market cap is often regarded as the single most important indicator for ranking cryptocurrencies. Former BitGo engineer and Bitcoin proponent Jameson Lopp has estimated that 4 million Bitcoins have been lost. A cryptos market cap is not a good measure of its actual value.

Cryptocurrency market capitalization provides no information regarding the future direction the price will take. So far BTC dominance was always greater than 60 a fact that explains why a move in BTC prices is affecting ALL other cryptocurrencies. The growing cryptocurrency market capitalization is an important aspect for potential investors.

No part of the equation determines the future coin supply. Market capitalization or market cap as it is usually called is the most straightforward indicator of the value of a coin in the market. Fortunately for me the person who explained it to me stressed one key thing that a lot of people miss.

For this reason market cap is often regarded as the single most important indicator for ranking cryptocurrencies. How is Market Cap calculated. The general way the market cap is calculated is the last traded price or the average traded price of a coin multiplied by its total circulating coin supply.

Not only would a higher circulating supply likely affect the price of cryptocurrencies but some altcoins have no upper limit. With more people buying bidding the price the market cap for a new currency gets higher. For example in the case of Bitcoin when a Bitcoin is traded at 10000 we multiply that by its total circulating supply 164 million coins to generate an approximate market cap of 164 billion USD.

While market cap is our best estimation of relative size for cryptocurrencies its not perfect. If you were to ask the average person in the cryptocurrency community where they go to find the success of a specific digital currency theyll likely point to sites like World Coin Index Coin Market Cap or some other market cap platform. A healthy market cap is indicative of a strong coin but developers or whales holding coins can mislead.

The market cap of a cryptocurrency is determined by the current price multiplied by the circulating supply. However the sudden increase in supply and fall in demand would cause crypto prices to crash in turn. Circulating Supply Issues and Their Impact on Market Cap.

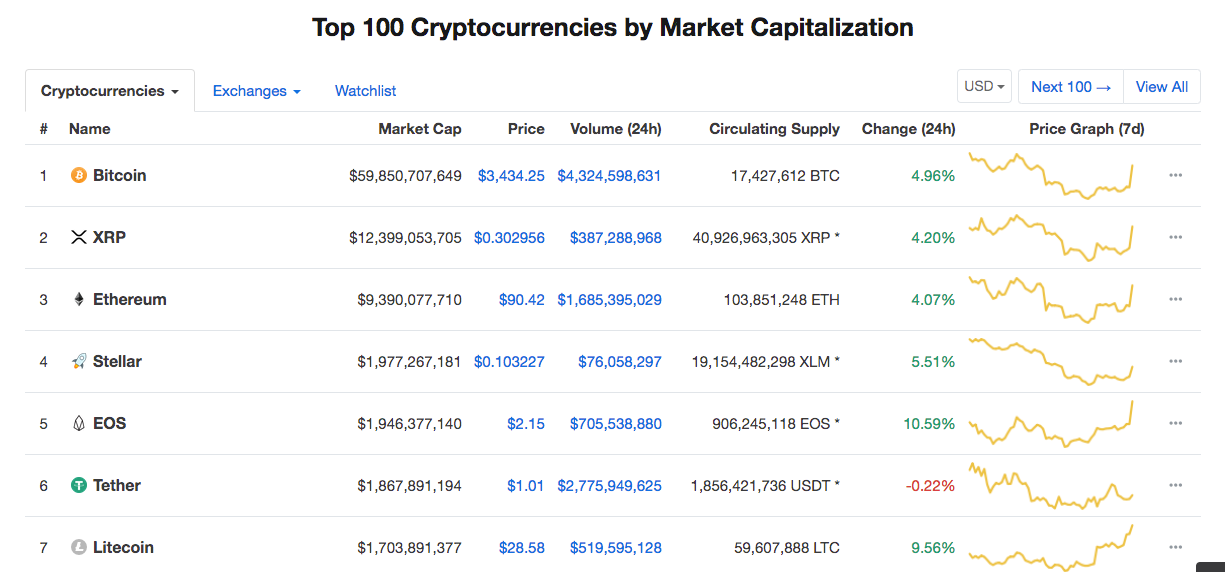

Coinmarketcap is currently the most popular website to keep track of market cap of cryptocurrencies. BTC dominance shows the percentage of BTC Market Cap relative to the WHOLE Crypto Market Cap to show the percentage of BTC cap to all other crypto Market Cap. This is largely a result of imperfections in circulating supplies.

A market capitalization essentially shows the amount of demand for the cryptocurrency. Always weigh market cap with some of the other metrics we cover before making an investment decision. The standard definition is market cap.

A market cap is both a quick way to gauge a coins value and a more than it seems. Instead the code defines whether the. Price 24h Volume and Circulating Supply Followed by market cap is price 24 hour volume and circulating supply.

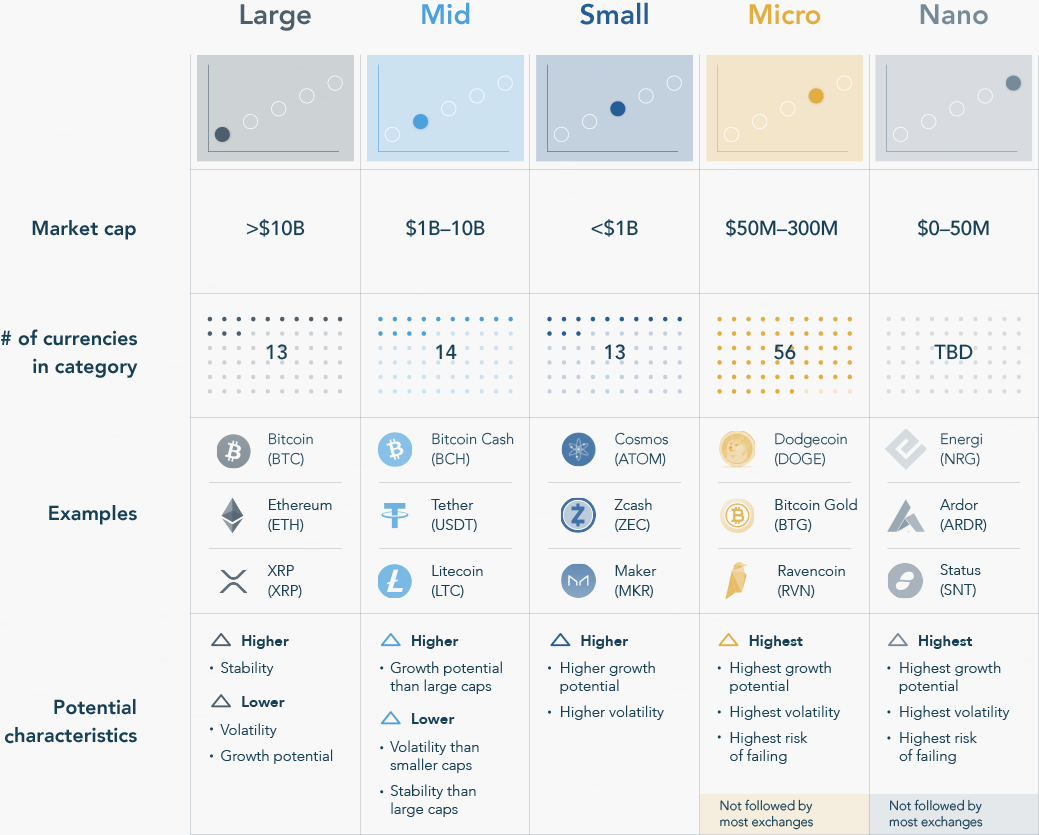

Market Cap Price X times Circulating Supply. Cryptocurrencies with large market cap such as Bitcoin tends to have less price volatility compared. This can be difficult to do.

A large market cap in cryptocurrency can indicate both the high cost of one coin or a large number of coins in circulation. Based on the rankings these lists provide users believe they can garner further. Market cap is calculated by multiplying the total supply of the coins with the price of each coin.

Cryptocurrency market cap is represented by this handy equation. Current market price x circulating supply total of coins in the market crypto market cap. The market cap is to identify the value of a cryptocurrency and accurately compare it against other cryptos.

This is primarily a result of early adopters who mined or purchased. For example an increase in Bitcoins price would definitely drive market capitalization up thus investors liquidating their assets in order to crystallize their gains. Bitcoins large market cap provides no immunity against price drops.

Market Capitalization is simply the amount of Fiat Money USD EUR GBP etc invested into a crypto currency. The higher the market cap of a cryptocurrency the more dominant it is considered to be in the market. Here market capitalization is calculated by multiplying an altcoins price by the maximum number of coins that could ever exist.

The Value Of Crypto Market Capitalization Do Coin Prices Matter

Market Cap Meaning For Cryptocurrency And Why It S Important

Market Capitalization Overview And Explanation Of Its Main Factors

Why Market Cap Is A Meaningless Dangerous Valuation Metric In Crypto Markets By Anthony Back The Blockchain Review By Intrepid Medium

Cryptocurrency Market Caps And Volatility By Bitgo Editor Official Bitgo Blog

What Is Crypto Market Cap Coinmarketcap

0 Comments