Since digital currency developers dont publish financial statements market cap is one of the few means of assessing the present value of a digital currency. Unlike conventional assets such as cash or stocks cryptocurrencies are unregulated and wholly decentralized.

Why Market Cap Is A Meaningless Dangerous Valuation Metric In Crypto Markets By Anthony Back The Blockchain Review By Intrepid Medium

The Crypto Market Cap breaks new lows into a 135 Trillion level BTC holds above 30k level and ETH is at about 2k level which still feels healthy for the 2 dragon heads however the other smaller coins are all in meltdown mode you may think I am into stocks I dont touch crypto at all doesnt matter to me right.

Why does crypto market cap matter. For established coins like Bitcoin and Ethereum it may offer investors an insight about the coins dominance or bearbull periods but concerning newer projects youre better off researching other metrics. What does Market Cap Mean in Crypto. By contrast Cardano is less experimental in.

Market capitalization is an indicator that measures and keeps track of the market value of a cryptocurrency. Market value between 3 billion and 10 billion. Generally mature well-known companies within established industries.

Though many people use this metric you may need to access other information before making any trading decisions. Market Capitalisation is an indicator that keeps track of and measures the market value of cryptocurrency. Low market cap coins have more potential for growth but they also come with a lot more risk.

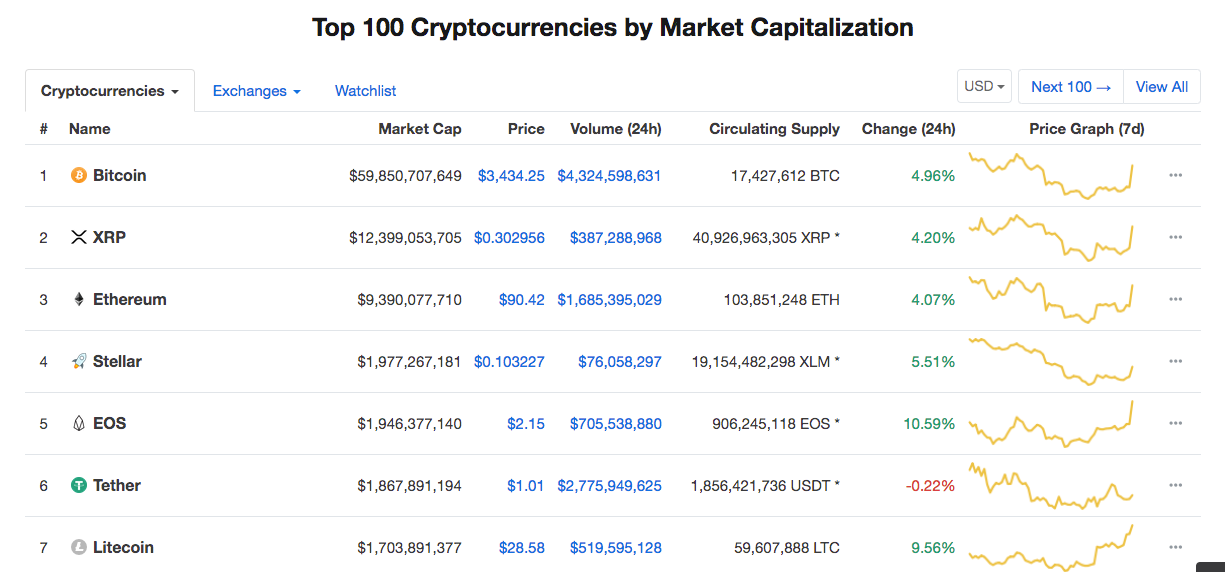

Market Cap Circulating Supply X Price. Though this metric is widely used more information before making trading decisions is recommended. In recent years the crypto market cap has evolved drastically in.

Another important metric is trading volume which is frequently used to evaluate the investment potential of an emerging digital currency. Cap is short for market capitalization which is the value of a company on the open market. Why is market cap relevant to cryptos.

In crypto the market value is calculated by multiplying the total number of coins mined at any given time by the price of a single coin. Because of this crypto market cap can be used as a good indicator of a particular cryptocurrencys presence in the market. This is why stock market analysts and crypto analysts use market capitalization to make informed investment decisions.

Thus meaning that the supply of coins in the market is controlled entirely by the community ie. A lot of people enter stonks or crypto believing that Market Cap is marketcap and they see it as a slang for the absolute top ceiling value of something. The market cap is calculated as current price circulating supply and is often a better although not perfect indicator of a coins valuation by investors.

Market value of 10 billion or more. They believe market cap means the highest value an asset hit for that cycle assuming 24 hours. The market value or market cap is the total dollar value of all the shares of a company or in the case of Bitcoin or any other cryptocurrency of all the mined currencies.

21 Gwei Headlines Insights. The price of a share alone can give an inaccurate measure of the size of the company. So why is that market cap so relevant to cryptos.

First published on Fintech Insider. Its used everywhere as a justification for investment. Coin market cap shows coin volatility and popularity in the long term.

If you want to find the next gem coin look for coins that have a low market cap. Market cap is used as an indicator of the dominance and popularity of cryptocurrencies. Likewise the price of a cryptocurrency can give an inaccurate measure of the total value of the cryptocurrency.

For us to understand the principles of total and altcoin market caps we must first start by outlining what market capitalisation is and how it is calculated. This is an important metric because its what we most often use to rank cryptocurrencies by their relative sizes. Market cap definitions can vary so the following are general guidelines.

The market cap is a simplistic way of looking at a crypto project to derive its value without doing an extensive fundamental and technical analysis of each crypto asset. Market cap or market capitalization is a calculation that emerged from traditional finance but one that has also seeped into the crypto world. A cryptocurrency with these factors would mean that it is proving itself relevant in the market causing its market cap to grow as more investors hold on to or mine the crypto coin.

Market cap is used as an indicator of the dominance and popularity of cryptocurrencies. It serves as an indicator of the popularity and dominance of crypto. Market capitalisation is an indicator that measures and keeps track of the market value of a cryptocurrency.

A popular assumption within the cryptocurrency space behind why a particular coin cannot reach a certain price is because the market cap will be too high and it is impossible for this much capital to go into it. Market Cap short for market capitalization is quite simply the circulating supply of a cryptocurrency multiplied by its current price. Why does crypto matter.

Time will tell whether or not Ethereum remains the second largest cryptocurrency by market cap behind Bitcoin.

What Is Market Cap In Cryptocurrency

The Value Of Crypto Market Capitalization Do Coin Prices Matter

What Is Crypto Market Cap Coinmarketcap

What Is Market Cap And Why Does It Matter Bitpanda Academy

The Value Of Crypto Market Capitalization Do Coin Prices Matter

0 Comments