The volume-weighted average price VWAP for each cryptocurrency incorporates pricing data from over 200 licensed exchanges weighted by trading volume. Using a market-cap-weighted index is not new either.

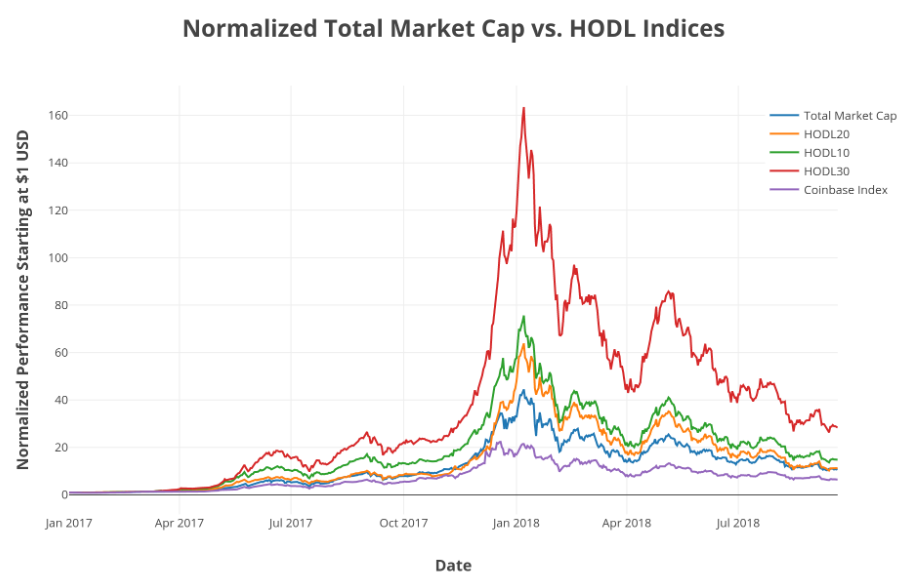

Crypto Index Comparison Which Index Has The Highest Return By Lukas Wiesflecker Coinmonks Medium

The Nasdaq Crypto Index NCI was specifically designed with these challenges in mind.

Crypto market cap weighted index. Each crypto index is made up of a selection of cryptocurrencies grouped together and weighted by market capitalisation market cap. December 31 2016 of Constituents. A market cap weighted index means the funds are distributed to each constituent based on each individual assets contribution to the sum of all assets market caps in the fund.

The Bitwise 10 Large Cap Crypto Index BITX tracks the total return of the 10 largest cryptoassets as measured and weighted by free-float market capitalization. A cap-weighted crypto index BC10 is a daily cap-weighted index which uses the market capitalisations of the top ten cryptocurrencies on any given day to calculate its value. The Crescent Crypto Market Index.

Choosing a market cap weighted index means the portfolio will be allocated based on the weight of each assets market cap relative to the other assets in the portfolio. The First Major Crypto Index. Using a market cap weighting means the index is as close as possible to tracking the actual value held in the market being tracked.

Founded in 2017 Bitwise is considered a leading provider of crypto index fund investment services. Both the SP 500 and NASDAQ indices deploy the same technique in the equities market. Market Cap Weighted Index When creating a market cap weighted index there are 3 main settings to consider.

It uses a high-fee AMM to rebalance gradually toward portfolio targets which are set. Certain Coins Categorically Excluded. Too much fund out from crypto.

Including 200 cryptocurrencies weighted by market capitalization the headline index CMC Crypto 200 Index CMC200 which includes Bitcoin essentially covers more than 90 of the global cryptocurrency market. Of Assets Minimum Asset and Maximum Asset. All crypto assets are held in 100 cold storage the safest way to store crypto assets.

The BGCI is a market cap-weighted index which implies that cryptocurrencies with higher market cap will have a higher weight in the indexBGCI. You can also compare market cap dominance of various cryptocurrencies. Index Administration The index is calculated and administered by Solactive AG an independent index provider based in Germany.

Pioneered in the crypto asset management space Bitwise created one of the worlds first cryptocurrency index funds called Bitwise 10 Private Index Fund. CC10 is a passively managed capitalization-weighted index that tracks the top 10 tokens by market cap from the Cryptocurrency market sector defined by NDX governance. Crescent Crypto Market Index CCMIX Index Type.

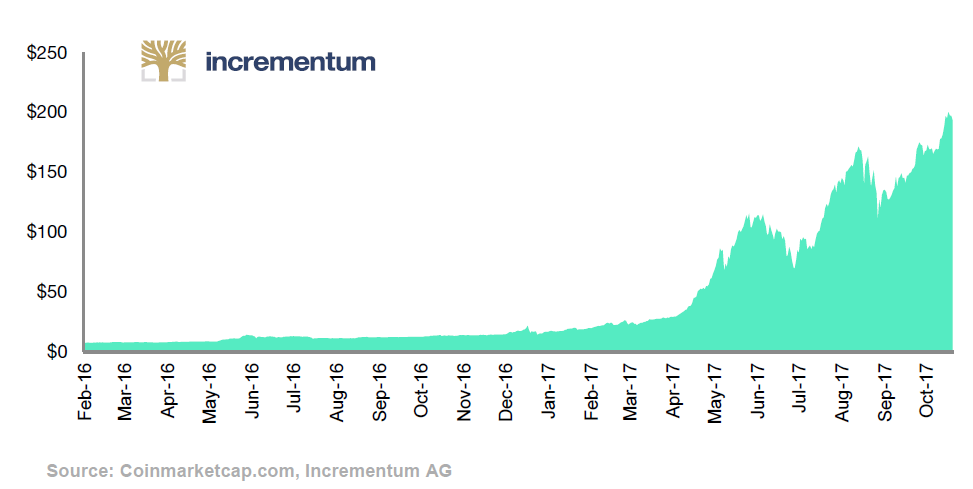

The charts below show total market capitalization of Bitcoin Ethereum Litecoin XRP and other crypto assets in USD. Of Assets Minimum Asset and Maximum Asset. And It went upto 2577T Mean to say that almost -54 down from High.

Now Total Market cap is 1381 Trillion dollar. Crypto Total Market Cap Update. Trailing 90-day Average Market Cap.

Another index excluding Bitcoin CMC Crypto 200 ex BTC Index CMC200EX has also been created to track the performance of the market without the influence of Bitcoin a cryptocurrency dominating 50 of total market capitalization. Market cap weighted rebalanced monthly. Our features Safe Storage.

The Crypto Index Fund is weighted by 5-year diluted market cap and is rebalanced monthly. Calculated daily in real-time. The top 5 cryptocurrencies are then weighted by market capitalization with no cap or floor and then included with their respective weights in the index.

Market Capitalization Weighted Cryptocurrencies are ranked by market capitalization on the last business day of every month. Investors must be US-based and accredited and the minimum investment is 25000. Invest Now INDEX.

Say hello to BC10. In this case cryptocurrency. When creating a market-cap-weighted index there are 3 main settings to consider.

Choosing a market-cap-weighted index means the portfolio will be allocated based on the weight of each assets market cap relative to. Free float market cap weighted. The market cap of a cryptocurrency is calculated by multiplying the number of units of a specific coin by its current market value against the US dollar.

With a well-diversified exposure this fund tracks the 10 largest cryptocurrencies weighted by 5-year diluted market capitalization and the rebalancing of the fund happens every month. The Index is designed to. Members of MCA family of benchmarks.

Crypto market cap charts. An Index for Cryptocurrencies The CB10 index provides market-cap-weighted exposure to ten crypto assets.

Crypto Index Comparison Which Index Has The Highest Return By Lukas Wiesflecker Coinmonks Medium

Cci 30 Top 30 Crypto Index Fund Cci 30 Index Fund 10 Finally I Ve By Balazs Lesko Medium

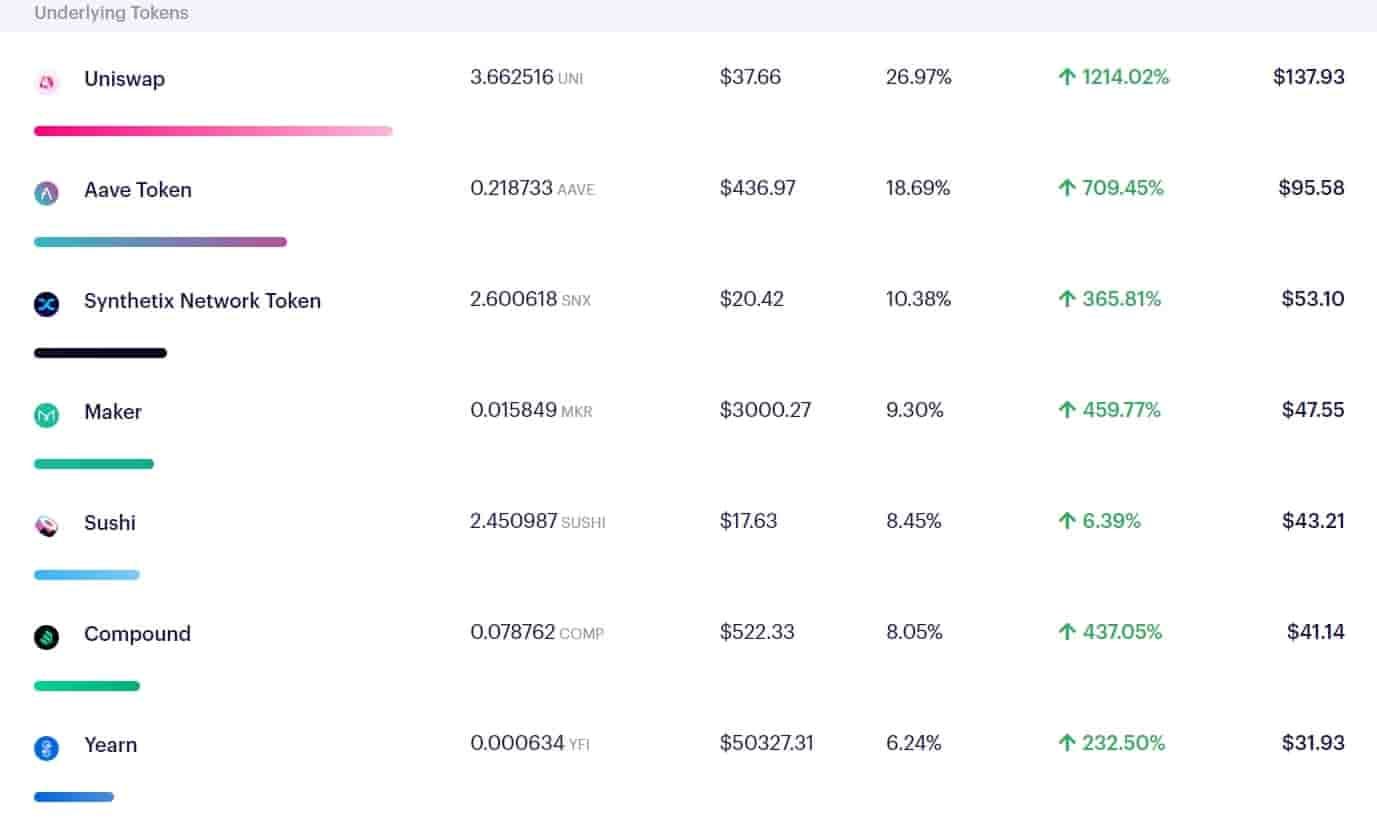

Cryptocurrency Top 10 Index Price Cc10 Chart Market Cap And Info Coingecko

Constructing A Cryptocurrency Index Crypto Research Report

Cryptocurrency Top 10 Index Price Cc10 Chart Market Cap And Info Coingecko

Crypto Index Comparison Which Index Has The Highest Return By Lukas Wiesflecker Coinmonks Medium

0 Comments